20+ Kentucky Retirement Systems: The Ultimate Guide To A Secure Future

An Overview of Kentucky Retirement Systems

The Kentucky Retirement Systems (KRS) is a comprehensive pension plan designed to provide financial security and peace of mind to public employees across the state. With over 20 retirement systems in place, KRS offers a range of benefits tailored to different professions, ensuring that every public servant’s retirement needs are met. In this guide, we will explore the various aspects of KRS, from its history and structure to the benefits it offers and the steps you need to take to ensure a secure future.

History and Evolution of KRS

The roots of KRS can be traced back to the early 20th century when the need for a retirement system for public employees became evident. Established in 1944, KRS has since grown and evolved to become one of the largest and most diverse retirement systems in the United States. Over the years, KRS has adapted to the changing needs of its members, introducing new plans and benefits to cater to different professions and demographics.

The Structure of Kentucky Retirement Systems

KRS consists of multiple retirement systems, each designed for specific groups of public employees. These systems are tailored to meet the unique needs of different professions, ensuring that each member receives the benefits they deserve. Here’s an overview of the key retirement systems within KRS:

Kentucky Employees Retirement System (KERS): KERS is the primary retirement system for most state and local government employees, including teachers, police officers, and firefighters. It offers a defined benefit plan, providing a secure retirement income based on years of service and salary.

County Employees Retirement System (CERS): CERS is similar to KERS but is specifically designed for county government employees. It provides retirement benefits to those working in various county departments, ensuring a comfortable retirement.

State Police Retirement System (SPRS): As the name suggests, SPRS is dedicated to Kentucky State Police officers. It offers unique benefits tailored to the demands and risks associated with law enforcement careers.

County Officers’ Retirement System (CORS): CORS is for elected county officials, such as judges, sheriffs, and clerks. It recognizes the distinct nature of their service and provides retirement benefits accordingly.

Legislative Retirement System (LRS): LRS is exclusive to members of the Kentucky General Assembly, offering retirement benefits to those who serve in the state legislature.

Judicial Retirement System (JRS): JRS is designed for judges and other judicial officers, providing retirement benefits that recognize the unique nature of their service.

Kentucky Public Pensions Authority (KPPA): KPPA is the administrative body overseeing all KRS retirement systems. It ensures the smooth operation and management of the pension plans, working towards the financial security of public employees.

Benefits and Features of KRS

KRS offers a wide range of benefits and features designed to provide financial security and flexibility to its members. Here are some key advantages:

Defined Benefit Plans: KRS primarily operates on defined benefit plans, which provide a guaranteed retirement income based on factors like years of service and final salary. This ensures a predictable and stable retirement income.

Cost-of-Living Adjustments (COLAs): KRS retirement benefits often include COLAs, which help keep up with inflation. These adjustments ensure that retirement income remains valuable over time.

Survivor Benefits: KRS offers survivor benefits, providing financial support to the families of deceased members. This ensures that the legacy of public service continues to be honored.

Early Retirement Options: Depending on the retirement system, KRS members may have access to early retirement options, allowing them to retire before the traditional retirement age.

Health Insurance Benefits: Some KRS retirement systems provide access to health insurance benefits, ensuring that members and their families have access to quality healthcare during retirement.

Investment Options: KRS members often have the flexibility to choose from a range of investment options, allowing them to customize their retirement savings strategy.

Eligibility and Enrollment

To be eligible for KRS, you must be a public employee in Kentucky working for a participating employer. This includes state and local government entities, as well as certain non-profit organizations. Enrollment in KRS is typically automatic upon becoming a public employee, but it’s essential to understand the specific retirement system you are enrolled in and the benefits it offers.

Retirement Planning with KRS

Effective retirement planning is crucial to ensure a secure future. Here are some steps to help you maximize the benefits of KRS:

Understand Your Retirement System: Familiarize yourself with the specific retirement system you are enrolled in. Learn about the benefits, contribution rates, and any unique features it offers.

Maximize Your Contributions: Consider contributing the maximum amount allowed to your retirement account. This can help you accumulate more savings and potentially benefit from employer matching contributions.

Diversify Your Investments: Explore the investment options available within KRS. Diversifying your portfolio can help manage risk and potentially increase your retirement savings.

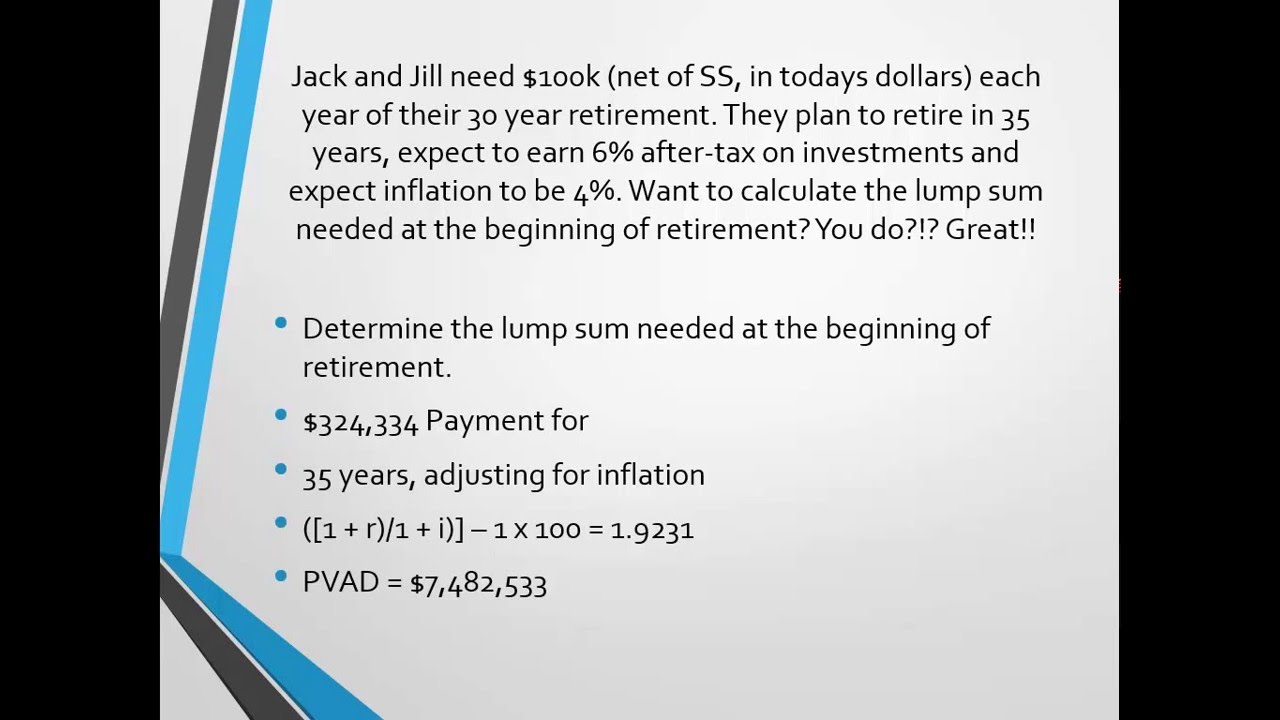

Utilize Retirement Calculators: KRS provides retirement calculators and planning tools to estimate your future retirement income. Use these tools to set realistic retirement goals and make informed decisions.

Stay Informed: Keep yourself updated on any changes or improvements to KRS. Attend retirement planning workshops or seminars to stay informed about the latest developments.

Notes:

Contribution Rates: It’s important to note that contribution rates may vary depending on the retirement system and your employer. Ensure you understand the contribution requirements to make the most of your retirement savings.

Vesting Periods: Vesting periods determine when you become eligible for full retirement benefits. Understand the vesting requirements of your retirement system to ensure you meet the necessary criteria.

Retirement Age: The traditional retirement age for KRS is typically 65, but early retirement options may be available. Consult the specific retirement system guidelines to determine your retirement age.

Beneficiary Designation: Ensure you designate a beneficiary for your KRS retirement benefits. This ensures that your loved ones receive the financial support they need in the event of your passing.

Visualizing KRS Retirement Systems

| Retirement System | Description |

|---|---|

| Kentucky Employees Retirement System (KERS) | Primary retirement system for state and local government employees |

| County Employees Retirement System (CERS) | Retirement system for county government employees |

| State Police Retirement System (SPRS) | Exclusive to Kentucky State Police officers |

| County Officers’ Retirement System (CORS) | Designed for elected county officials |

| Legislative Retirement System (LRS) | For members of the Kentucky General Assembly |

| Judicial Retirement System (JRS) | Tailored for judges and judicial officers |

| Kentucky Public Pensions Authority (KPPA) | Administrative body overseeing all KRS retirement systems |

Conclusion:

Kentucky Retirement Systems offers a comprehensive and diverse range of retirement benefits to public employees across the state. By understanding the structure, benefits, and planning strategies, you can ensure a secure and comfortable retirement. Remember to stay informed, maximize your contributions, and utilize the resources provided by KRS to make the most of your retirement journey. With proper planning and the support of KRS, you can look forward to a financially stable future.

FAQ

What is the minimum age to retire with KRS benefits?

+The minimum age to retire with KRS benefits varies depending on the retirement system and your years of service. Generally, the traditional retirement age is 65, but early retirement options may be available with reduced benefits.

Can I transfer my KRS retirement benefits if I move to another state?

+Yes, KRS retirement benefits are portable. If you move to another state, you can transfer your benefits to a similar retirement system in your new state of residence.

Are there any penalties for early retirement with KRS?

+Early retirement with KRS may result in reduced benefits. The extent of the reduction depends on your retirement system and the number of years you retire early. It’s best to consult the specific guidelines for your retirement system.

Can I contribute to KRS if I am self-employed or work for a private employer?

+No, KRS is specifically designed for public employees. If you are self-employed or work for a private employer, you may need to explore other retirement savings options, such as individual retirement accounts (IRAs) or employer-sponsored plans.

How can I estimate my future retirement income with KRS?

+KRS provides retirement calculators and planning tools on their website. These tools allow you to input your years of service, salary, and other relevant information to estimate your future retirement income. It’s a useful way to plan and set retirement goals.