20+ Navy Fed Pay Dates: The Ultimate Guide To Your Payday

Staying informed about your pay dates is crucial for effective financial planning. This comprehensive guide will help you navigate the Navy Federal pay schedule, ensuring you're always prepared for your upcoming paydays. Let's dive in and explore the details.

Understanding the Navy Federal Pay Schedule

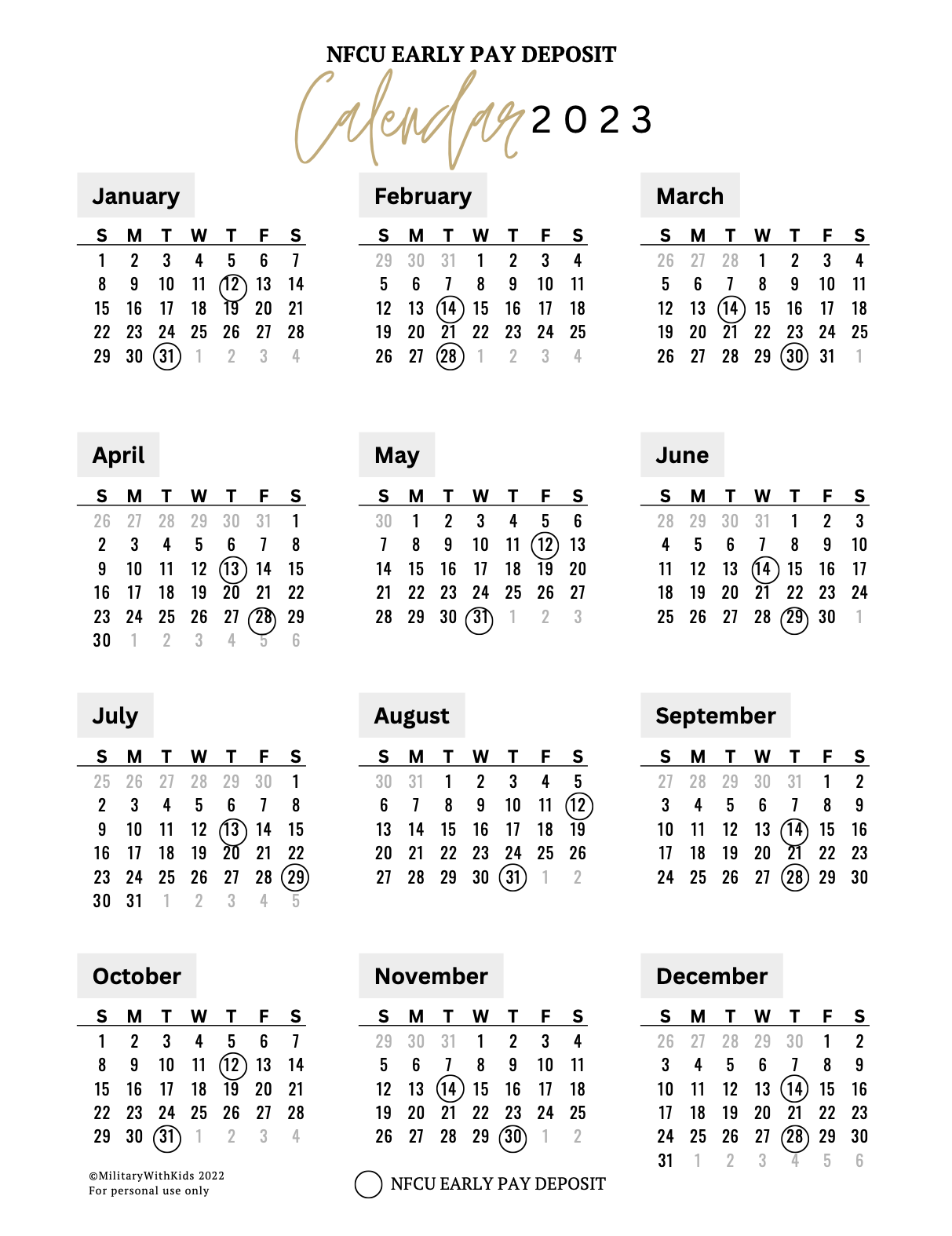

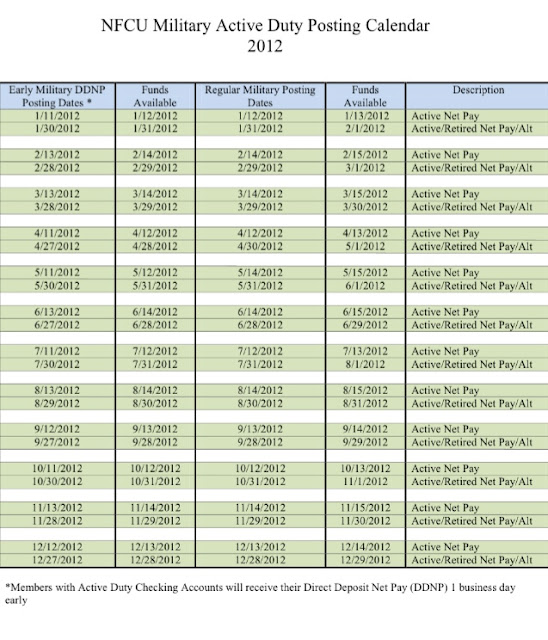

Navy Federal Credit Union, often referred to as NFCU, follows a bi-weekly pay schedule, ensuring a consistent income flow for its members. Here's a breakdown of the pay dates throughout the year, categorized by months for easier reference.

Pay Dates by Month

Below is a table outlining the pay dates for each month. Please note that these dates are approximate and may vary slightly due to weekends and holidays.

| Month | Pay Dates |

|---|---|

| January | 7th, 21st |

| February | 4th, 18th |

| March | 4th, 18th |

| April | 1st, 15th, 29th |

| May | 13th, 27th |

| June | 10th, 24th |

| July | 8th, 22nd |

| August | 5th, 19th |

| September | 2nd, 16th, 30th |

| October | 14th, 28th |

| November | 11th, 25th |

| December | 9th, 23rd |

Tips for Effective Financial Management

Knowing your pay dates is just the first step towards financial control. Here are some additional tips to help you manage your finances effectively:

- Create a Budget: Plan your expenses and savings by creating a monthly budget. Allocate funds for essentials, entertainment, and savings.

- Automate Your Savings: Set up automatic transfers to your savings account with each payday. This ensures you consistently save a portion of your income.

- Track Your Spending: Monitor your expenses to identify areas where you can cut back. Use budgeting apps or spreadsheets to keep track of your spending habits.

- Set Financial Goals: Define short-term and long-term financial goals, such as saving for a vacation or retirement. Break down these goals into achievable milestones.

- Review Your Pay Stubs: Regularly check your pay stubs for accuracy and ensure all deductions and contributions are as expected.

Special Pay Dates and Considerations

While the bi-weekly pay schedule is standard, there are instances where pay dates may vary or additional considerations come into play. Here are some special cases to be aware of:

Holidays and Weekend Pay Dates

When a scheduled pay date falls on a weekend or a holiday, Navy Federal may adjust the pay date to the preceding Friday or the following Monday. It's essential to stay updated with any changes to ensure you receive your payment on time.

Direct Deposit and Payment Methods

Navy Federal offers various payment methods, including direct deposit, which is the most convenient and secure way to receive your paycheck. Ensure your direct deposit information is up-to-date to avoid any delays or issues with your payment.

Military Pay Dates

For active-duty military members, the pay dates may align with the Department of Defense's (DoD) pay schedule. Navy Federal typically processes military pay on the same dates as the DoD, ensuring timely payments.

Managing Your NFCU Account

Staying on top of your NFCU account and its features can further enhance your financial management. Here are some key aspects to consider:

- Online Banking: Utilize Navy Federal's online banking platform to access your account information, view transaction history, and transfer funds conveniently.

- Mobile App: Download the NFCU mobile app for easy access to your account on the go. Check your balance, deposit checks, and manage your finances remotely.

- Alerts and Notifications: Set up alerts and notifications to stay informed about important account activities, such as low balances or large transactions.

- Bill Pay: Take advantage of the bill pay feature to automate your recurring payments, ensuring timely payment of bills and avoiding late fees.

Conclusion

Staying informed about your Navy Federal pay dates is crucial for effective financial planning. By understanding the bi-weekly pay schedule and considering special cases, you can better manage your finances and make the most of your income. Remember to create a budget, automate your savings, and utilize the various tools and features offered by NFCU to stay on top of your financial goals.

Can I change my direct deposit information online?

+Yes, you can update your direct deposit information through the NFCU online banking platform or mobile app. Ensure you provide accurate details to avoid any payment delays.

What if I don’t receive my paycheck on the scheduled pay date?

+If you don’t receive your paycheck on the expected date, contact Navy Federal’s customer support for assistance. They can help investigate and resolve any payment issues.

Are there any additional fees for using NFCU’s online banking services?

+No, Navy Federal does not charge any fees for using its online banking platform. You can access your account information, transfer funds, and manage your finances without any additional costs.

Can I request a pay advance from Navy Federal?

+Navy Federal offers a Paycheck Advance Loan, which provides members with access to a portion of their future paychecks. However, it’s important to note that this is a loan and must be repaid with interest.

How can I stay updated with any changes to the pay schedule?

+Navy Federal communicates any changes to the pay schedule through its official website, mobile app notifications, and email updates. Stay connected to ensure you receive the latest information.