7 Ultimate Tips To Make Your 2Nd Lt Salary Count

For new Second Lieutenants, managing your finances can be a daunting task. With a limited salary, it's essential to make every dollar count and set yourself up for a solid financial future. Here are seven ultimate tips to help you make the most of your 2nd Lt salary.

1. Create a Realistic Budget

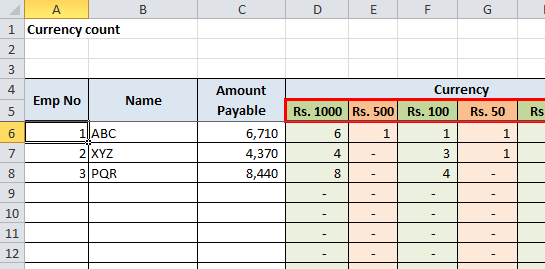

Start by understanding your income and expenses. Create a detailed budget that accounts for all your essential costs, such as rent, utilities, food, and transportation. Be realistic and include a buffer for unexpected expenses. By allocating your money wisely, you can ensure you’re not overspending and can save effectively.

2. Automate Your Savings

Set up automatic transfers from your paycheck to a dedicated savings account. This way, you’ll save effortlessly without the temptation to spend the money. Aim to save at least 10% of your income, but feel free to increase this percentage if you can afford it. Saving consistently will help you build an emergency fund and work towards your long-term financial goals.

3. Live Below Your Means

As a Second Lieutenant, it’s crucial to embrace a frugal lifestyle. Avoid the trap of keeping up with appearances and unnecessary expenses. Opt for affordable housing, cook your meals instead of dining out frequently, and consider second-hand items for furniture and clothing. By living below your means, you’ll have more money to allocate towards savings and investments.

4. Pay Off Debt Strategically

If you have any debt, such as student loans or credit card balances, create a plan to pay them off efficiently. Focus on high-interest debt first and consider consolidating your loans to get a lower interest rate. Making extra payments whenever possible will help you save on interest and become debt-free sooner.

5. Build an Emergency Fund

An emergency fund is a crucial safety net for unexpected expenses. Aim to save enough to cover at least three to six months’ worth of living expenses. This fund will provide peace of mind and prevent you from relying on high-interest debt during financial emergencies.

6. Invest for the Future

Once you’ve established a solid financial foundation, it’s time to think about investing. Consider contributing to your TSP (Thrift Savings Plan) or other retirement accounts. Take advantage of any matching contributions offered by your employer. Investing early gives your money more time to grow and compound, setting you up for a comfortable retirement.

7. Stay Informed and Educate Yourself

Financial literacy is a powerful tool. Stay updated on personal finance topics and educate yourself about different investment options. Read books, listen to podcasts, and attend workshops to enhance your financial knowledge. The more you understand about managing money, the better equipped you’ll be to make informed decisions.

Additional Tips

- Consider sharing expenses with a roommate to reduce your housing costs.

- Take advantage of military discounts wherever possible.

- Cook in bulk and meal prep to save time and money on groceries.

- Avoid impulse purchases and create a shopping list to stay focused.

- Negotiate bills and subscriptions to get the best deals.

💡 Note: Remember, everyone's financial situation is unique. These tips provide a general guide, but it's essential to tailor your financial plan to your specific needs and goals.

Conclusion

Managing your finances as a Second Lieutenant can be challenging, but with a well-thought-out strategy, you can make your salary work for you. By creating a budget, automating savings, and living frugally, you’ll be on the path to financial stability and a brighter future. Stay disciplined, and don’t be afraid to seek professional advice if needed. Your financial journey is an important part of your overall well-being, so take control and make it count!

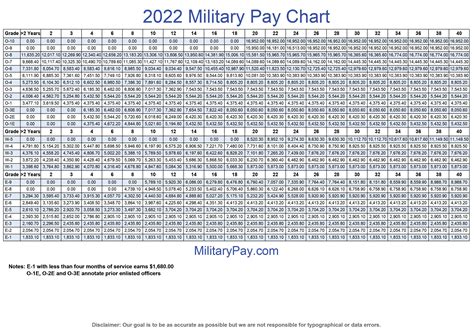

What is the average salary for a Second Lieutenant?

+The average salary for a Second Lieutenant can vary depending on factors such as branch of service, years of service, and location. As of my knowledge cutoff in January 2023, the base pay for a Second Lieutenant in the U.S. Army ranged from approximately 3,155 to 4,526 per month. However, it’s important to note that military pay is subject to change, and you may also be eligible for additional allowances and benefits.

How can I maximize my savings as a Second Lieutenant?

+To maximize your savings, consider the following strategies: Live frugally and avoid unnecessary expenses, take advantage of military discounts, cook at home instead of dining out, and automate your savings by setting up regular transfers to a dedicated savings account. Additionally, explore opportunities for additional income through part-time jobs or freelance work, ensuring they align with military regulations.

What are some investment options for Second Lieutenants?

+Second Lieutenants have various investment options, including the Thrift Savings Plan (TSP), which offers tax-advantaged retirement savings. Consider contributing to the TSP, especially if your employer offers matching contributions. Other investment options include mutual funds, stocks, bonds, and real estate. However, it’s crucial to research and understand the risks associated with each investment before making any decisions.

How can I reduce my living expenses as a Second Lieutenant?

+To reduce living expenses, consider sharing housing costs with a roommate, opt for affordable housing options, and explore military housing allowances. Cook your meals instead of eating out frequently, and look for deals and discounts on groceries and other necessities. Additionally, consider second-hand items for furniture and clothing to save money.

What are some common financial pitfalls to avoid as a Second Lieutenant?

+As a Second Lieutenant, it’s important to avoid common financial pitfalls such as excessive spending, high-interest debt, and lack of emergency savings. Impulse purchases, overspending on unnecessary items, and relying on credit cards with high-interest rates can quickly lead to financial strain. Instead, focus on creating a budget, saving for emergencies, and paying off debt strategically.