Create 7 Ultimate Ky Payroll Calculations Now

Introduction to Kentucky Payroll Calculations

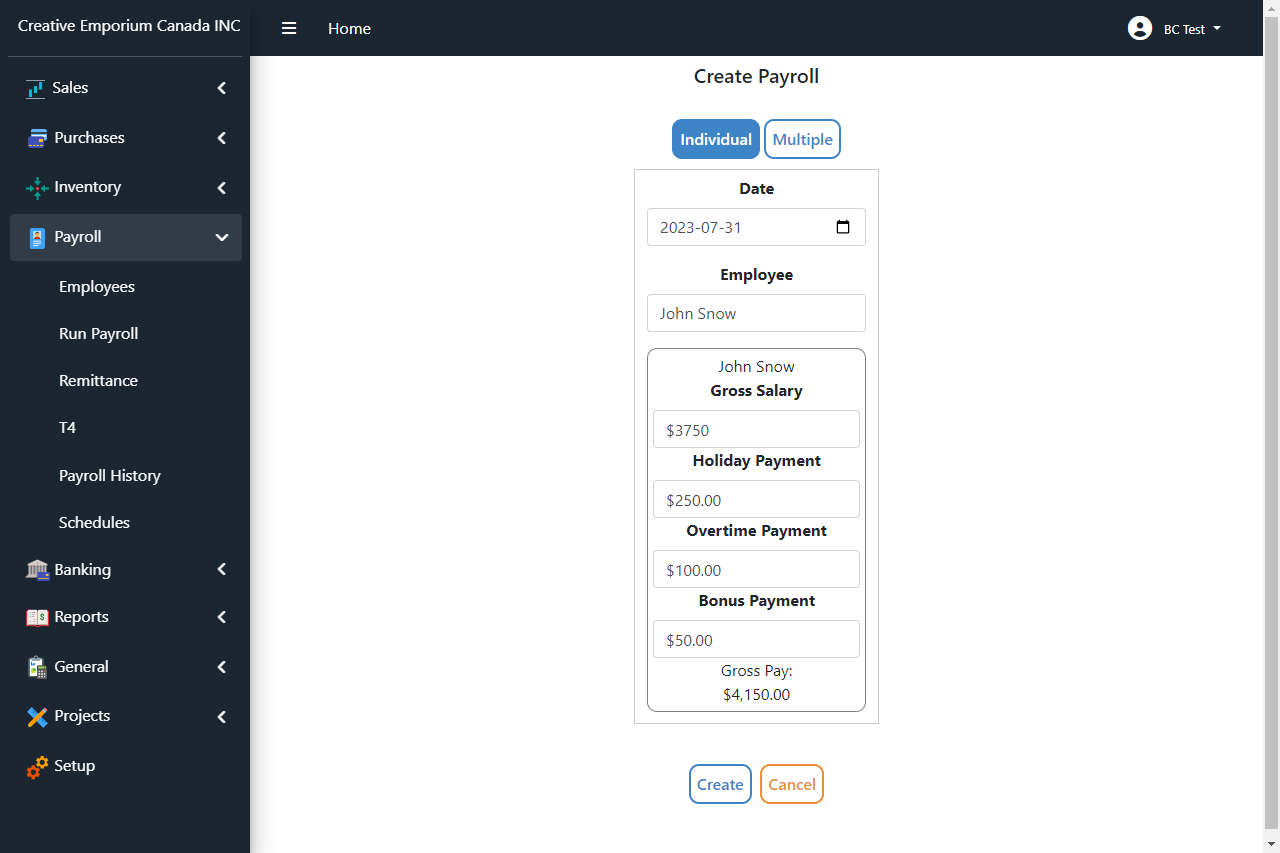

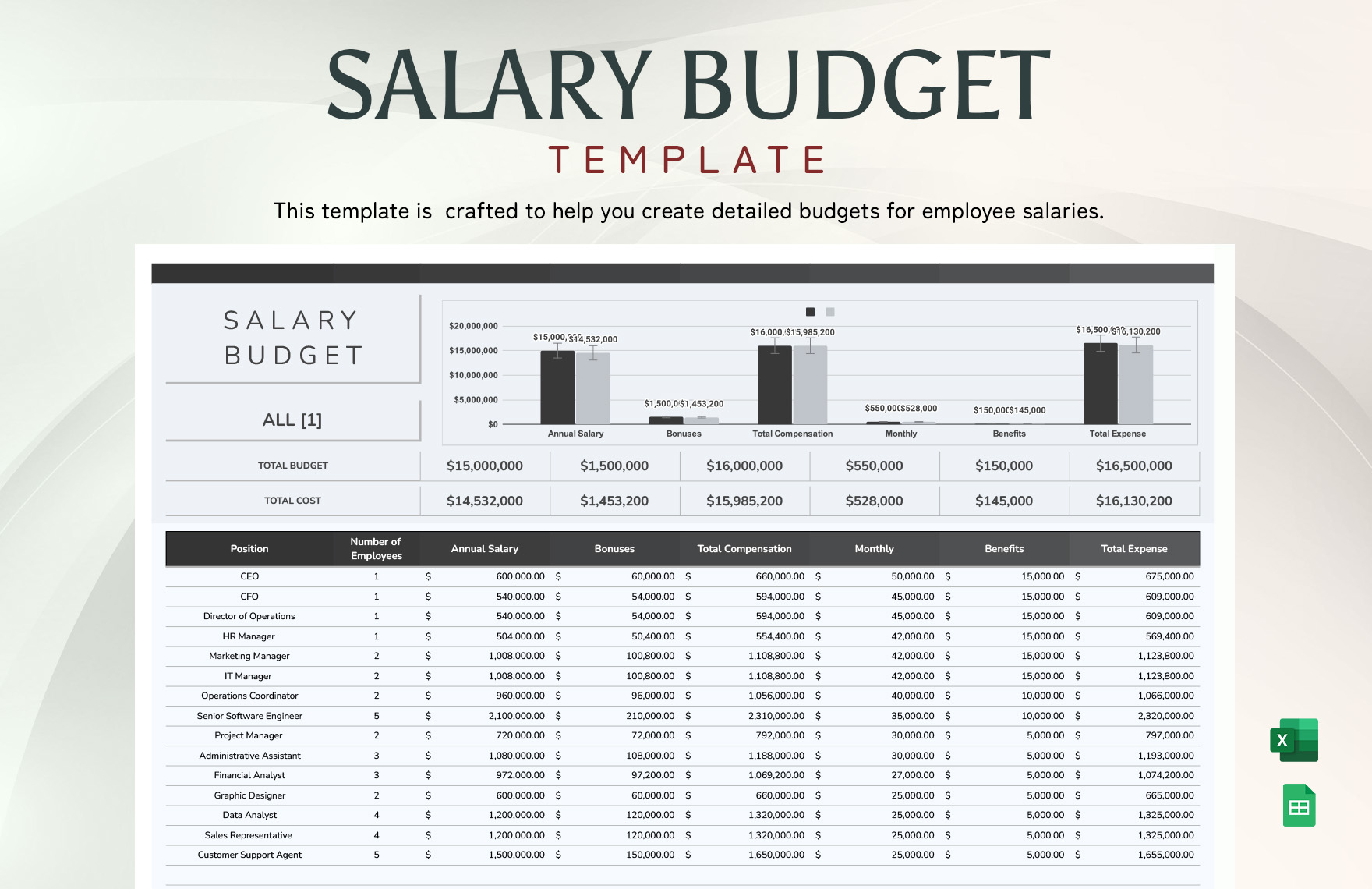

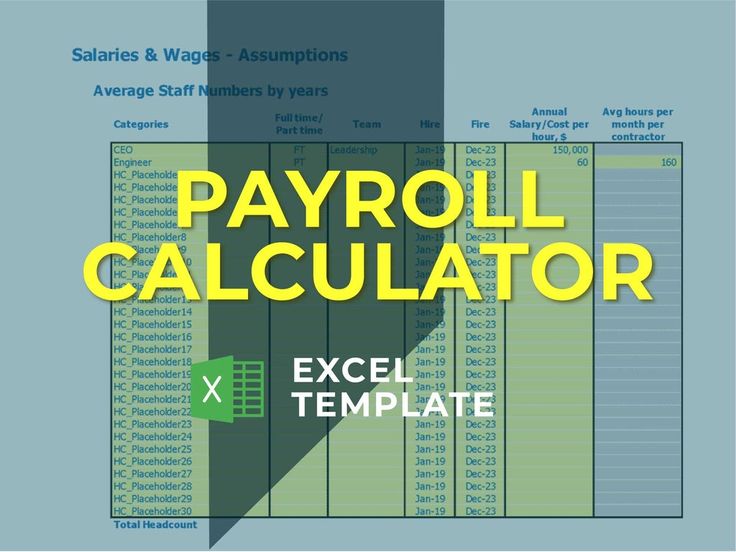

Payroll processing in Kentucky involves various calculations to ensure employees receive accurate compensation. This blog post will guide you through the essential payroll calculations specific to the state of Kentucky, helping you navigate the complexities of payroll management effectively.

Federal and State Income Tax Withholding

One of the crucial aspects of payroll calculations is determining the correct amount of income tax to withhold from employees’ paychecks. In Kentucky, the state income tax is in addition to federal income tax, and both are calculated based on the employee’s earnings and tax brackets.

Federal Income Tax Withholding

The federal income tax withholding is determined by the employee’s Form W-4 and the Internal Revenue Service (IRS) tax withholding tables. These tables consider the employee’s filing status, allowances, and income level to calculate the appropriate tax amount.

Kentucky State Income Tax Withholding

Kentucky has a progressive income tax system, meaning the tax rate increases as income rises. The state income tax is calculated based on the employee’s taxable income and the applicable tax rates for their filing status. Kentucky offers a standard deduction and personal exemptions, which can reduce the taxable income and, consequently, the state income tax liability.

Social Security and Medicare Taxes

Social Security and Medicare taxes are essential payroll deductions that contribute to the employee’s future retirement benefits and healthcare coverage. These taxes are mandatory and apply to all employees, regardless of their income level.

Social Security Tax (FICA)

The Social Security tax, also known as FICA (Federal Insurance Contributions Act) tax, is a flat rate of 6.2% on the employee’s gross wages up to a certain threshold, which is set annually by the IRS. In Kentucky, this threshold is known as the Social Security Wage Base. Any earnings above this limit are not subject to the Social Security tax.

Medicare Tax (FICA)

The Medicare tax is also a flat rate of 1.45% on the employee’s entire gross wages, with no threshold. Additionally, high-income earners may be subject to an Additional Medicare Tax of 0.9%, which is calculated on earnings above a certain threshold.

Unemployment Taxes

Unemployment taxes are essential for providing financial support to unemployed workers. In Kentucky, unemployment taxes are divided into two categories: Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA).

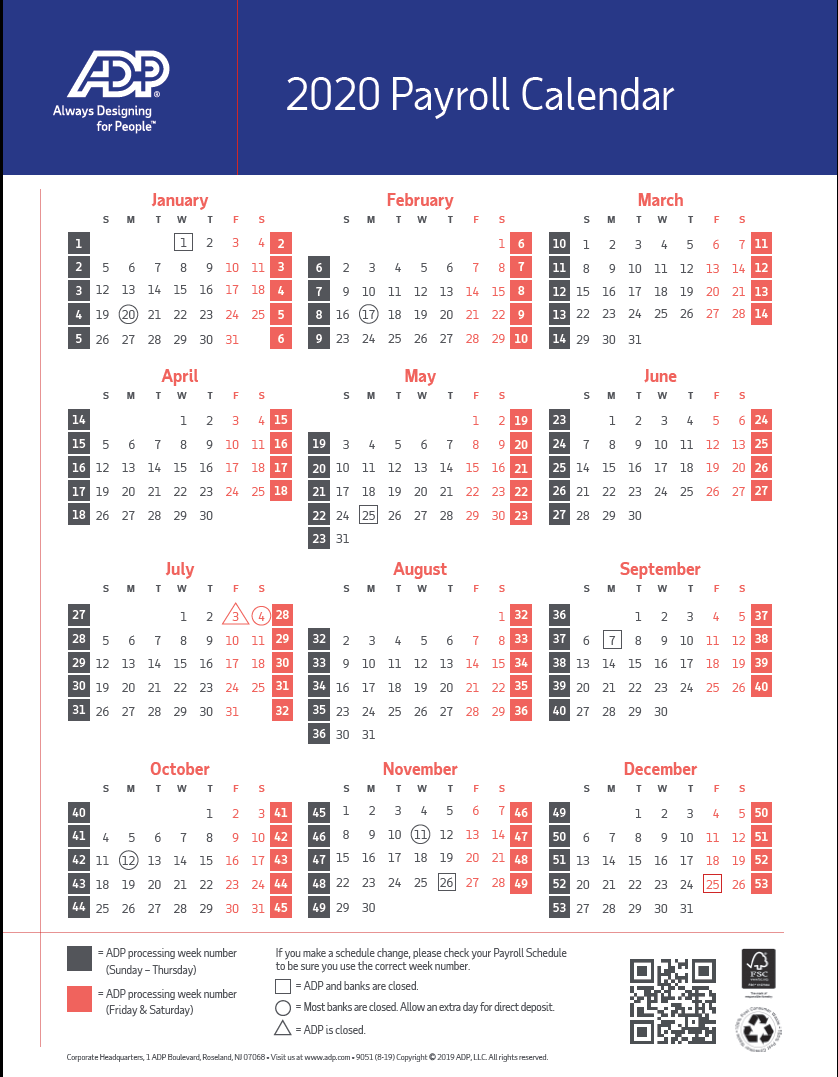

Federal Unemployment Tax (FUTA)

FUTA is a federal tax that applies to all employers, regardless of their state. The tax rate is 6% on the first $7,000 of an employee’s wages each year. However, Kentucky employers can claim a credit of up to 5.4% against their FUTA liability, effectively reducing the tax rate to 0.6%.

State Unemployment Tax (SUTA)

SUTA is a state-specific tax that varies from one state to another. In Kentucky, the SUTA tax rate is determined by the employer’s industry and experience rating. The tax is calculated as a percentage of the employee’s wages, and the rate can range from 0.1% to 10.3%.

Workers’ Compensation Insurance

Workers’ compensation insurance is a critical aspect of payroll calculations, as it provides financial protection to employees who suffer work-related injuries or illnesses. The cost of workers’ compensation insurance is typically determined by the employer’s industry, payroll, and claims history.

In Kentucky, employers are required to provide workers’ compensation insurance coverage for their employees. The premium rates for workers’ compensation insurance are set by the Kentucky Compensation Rating Board (KCRB) and are based on the employer’s classification code and payroll.

Voluntary Deductions

In addition to mandatory deductions, employees may opt for voluntary deductions from their payroll. These deductions can include contributions to retirement plans, such as 401(k) or 403(b) plans, flexible spending accounts (FSAs), health savings accounts (HSAs), or other employee benefits.

When processing voluntary deductions, it’s essential to ensure that the employee’s contributions do not exceed the maximum allowed by law. Additionally, employers should provide clear communication and education to employees regarding these deductions and their benefits.

Garnishments and Child Support Withholding

Garnishments and child support withholding are legally mandated deductions from an employee’s payroll. These deductions are typically ordered by a court or government agency and are used to satisfy debt obligations or provide financial support for children.

Employers in Kentucky are required to comply with garnishment and child support withholding orders. It’s crucial to accurately calculate and withhold the correct amounts to avoid legal consequences. Failure to comply with these orders can result in penalties and legal action.

Overtime Calculations

Overtime calculations are essential when employees work beyond their regular hours. In Kentucky, the federal Fair Labor Standards Act (FLSA) applies, which requires employers to pay overtime at a rate of 1.5 times the regular rate of pay for hours worked beyond 40 in a workweek.

To calculate overtime pay, employers must first determine the employee’s regular rate of pay. This rate is calculated by dividing the employee’s total earnings (excluding overtime pay) by the total number of hours worked. Then, multiply the regular rate by 1.5 to find the overtime rate. Finally, multiply the overtime rate by the number of overtime hours worked to determine the overtime pay.

Conclusion

Payroll calculations in Kentucky involve a range of considerations, from income tax withholding to overtime pay. By understanding these calculations and staying updated with the latest tax rates and regulations, employers can ensure accurate and compliant payroll processing. Remember to consult with tax professionals or use reliable payroll software to navigate the complexities of Kentucky payroll calculations effectively.

FAQ

What is the difference between Social Security and Medicare taxes?

+

Social Security tax, or FICA tax, is used to fund retirement benefits and disability programs. It is a flat rate of 6.2% on earnings up to a certain threshold. Medicare tax, on the other hand, funds healthcare coverage for the elderly and disabled. It has a flat rate of 1.45% on all earnings, with an additional 0.9% tax for high-income earners.

How are overtime hours calculated in Kentucky?

+

Overtime hours are calculated based on the number of hours worked beyond the standard 40-hour workweek. The overtime rate is 1.5 times the regular rate of pay, and it is applied to the hours worked above 40.

What is the process for handling garnishments and child support withholding orders?

+

Employers must comply with garnishment and child support withholding orders received from courts or government agencies. It is essential to accurately calculate and withhold the specified amounts from the employee’s payroll to avoid legal consequences.

Can employees opt out of voluntary deductions like retirement plan contributions?

+

Yes, employees have the right to opt out of voluntary deductions at any time. However, it is important to provide clear communication and educate employees about the benefits and potential consequences of opting out of these deductions.

How often should employers update their knowledge of Kentucky payroll regulations?

+

Employers should regularly review and update their knowledge of Kentucky payroll regulations to stay compliant. It is recommended to consult with tax professionals or subscribe to payroll updates to ensure accurate and up-to-date payroll processing.