Design 7 Expert Financial Management Strategies Today

In today's fast-paced and often unpredictable economic landscape, effective financial management is crucial for both individuals and businesses. Whether you're looking to secure your financial future, grow your wealth, or ensure the long-term stability of your business, these seven expert strategies will guide you toward achieving your financial goals.

1. Set Clear Financial Goals

Defining your financial objectives is the first step toward successful management. Whether it's saving for a dream vacation, paying off debt, investing in property, or growing your business, clear goals provide direction and motivation.

When setting financial goals, consider the following:

- Specificity: Be precise about what you want to achieve. Instead of a vague goal like "save more," aim for a specific target like "save $5,000 for an emergency fund by the end of the year."

- Time-Bound: Assign a deadline to your goals. This creates a sense of urgency and helps you track progress.

- Measurable: Ensure your goals are quantifiable. For instance, aim to reduce credit card debt by $2,000 instead of just "reduce debt."

- Realistic: Set goals that are achievable. While ambitious goals are important, ensure they are realistic to maintain motivation.

2. Create a Comprehensive Budget

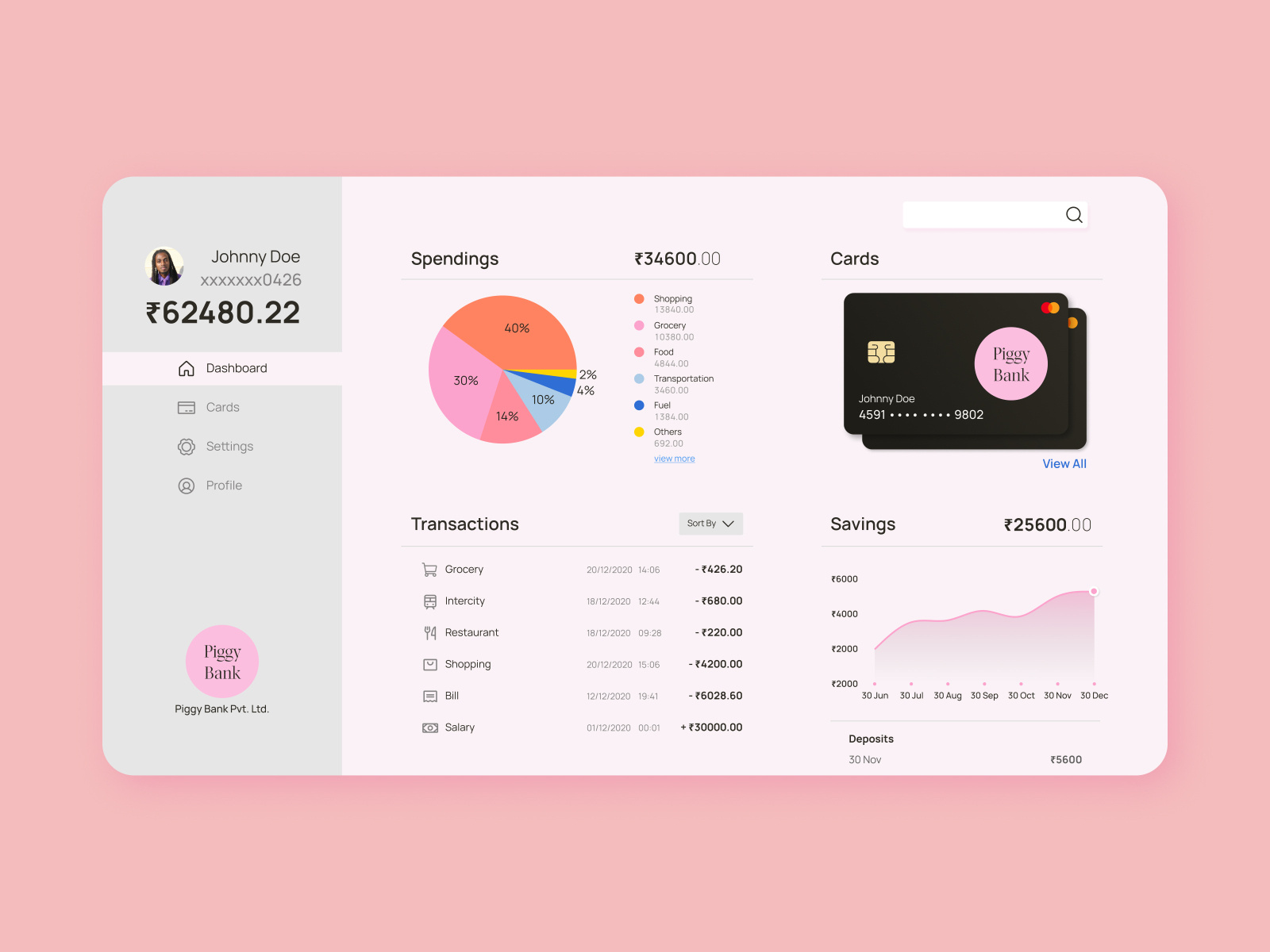

A budget is a powerful tool for managing your finances. It helps you understand your income, expenses, and savings, and allows you to make informed decisions about your money.

To create an effective budget, follow these steps:

- Track Your Expenses: Record all your monthly expenses, including fixed costs like rent and variable costs like groceries and entertainment.

- Analyze Your Spending: Review your spending habits to identify areas where you can cut back or save more. Look for unnecessary subscriptions or impulsive purchases.

- Allocate Your Income: Divide your income into essential expenses, savings, and discretionary spending. Ensure you prioritize saving and paying off debt.

- Adjust and Monitor: Regularly review and adjust your budget as needed. Life circumstances and financial goals may change, so keep your budget flexible and up-to-date.

3. Prioritize Debt Repayment

Debt can be a significant burden on your finances and overall well-being. Prioritizing debt repayment is essential for improving your financial health and securing a stable future.

Consider these strategies for effective debt management:

- Snowball Method: Focus on paying off the smallest debts first, gaining momentum as you tackle larger ones. This method provides quick wins and motivation.

- Avalanche Method: Prioritize paying off debts with the highest interest rates first. This approach saves you money in the long run by reducing the overall interest paid.

- Debt Consolidation: Consider consolidating multiple debts into one loan with a lower interest rate. This simplifies repayment and can save you money.

4. Build an Emergency Fund

An emergency fund is a financial safety net that provides peace of mind and protects you from unexpected expenses or income disruptions.

Here's how to build and maintain an emergency fund:

- Determine the Amount: Aim for at least three to six months' worth of living expenses. This provides a solid buffer for most unexpected situations.

- Automate Savings: Set up automatic transfers from your paycheck or monthly income into your emergency fund. This ensures consistent savings without the need for manual transfers.

- Keep it Accessible: Store your emergency fund in a high-yield savings account or money market account. These accounts offer easy access and competitive interest rates.

5. Invest for the Long Term

Investing is a powerful way to grow your wealth over time. It allows you to take advantage of compound interest and market growth, which can significantly increase your financial portfolio.

Consider these investment strategies:

- Diversify Your Portfolio: Spread your investments across different asset classes, industries, and geographic regions. Diversification reduces risk and provides a more stable return.

- Long-Term Perspective: Invest with a long-term view. Short-term market fluctuations are normal, but staying invested over the long term can lead to substantial gains.

- Consider Professional Advice: If you're new to investing or prefer a hands-off approach, consider working with a financial advisor. They can provide personalized guidance and help you navigate the market.

6. Maximize Retirement Savings

Planning for retirement is a crucial aspect of financial management. The earlier you start saving for retirement, the more time your investments have to grow and compound.

Here are some tips for maximizing your retirement savings:

- Employer-Sponsored Plans: Take advantage of employer-sponsored retirement plans like 401(k)s or pensions. Many employers offer matching contributions, which is essentially free money for your retirement.

- Individual Retirement Accounts (IRAs): If you don't have access to an employer-sponsored plan or want additional savings, consider opening an IRA. These accounts offer tax advantages and can be a great way to boost your retirement savings.

- Automate Contributions: Set up automatic contributions to your retirement accounts. This ensures consistent savings and makes it easier to reach your retirement goals.

7. Protect Your Assets with Insurance

Insurance is an essential component of financial management, providing protection against unexpected events that could derail your financial plans.

Consider the following types of insurance:

- Health Insurance: Medical expenses can be costly, so having health insurance is crucial. Shop around for plans that offer the coverage you need at a reasonable cost.

- Life Insurance: If you have dependents or significant financial obligations, life insurance can provide financial security for your loved ones in the event of your passing.

- Property Insurance: Protect your home, vehicle, and other valuable assets with appropriate insurance coverage. This ensures you're covered in case of accidents, theft, or natural disasters.

By implementing these expert financial management strategies, you can take control of your finances, achieve your goals, and secure a stable and prosperous future. Remember, financial management is an ongoing process, and regular review and adjustment are key to staying on track.

Frequently Asked Questions

What are the benefits of setting clear financial goals?

+Setting clear financial goals provides direction, motivation, and a sense of purpose for your financial journey. It helps you prioritize your spending, save effectively, and make informed decisions about your money.

How often should I review and adjust my budget?

+It’s recommended to review your budget at least once a month, especially if your financial situation or goals change. Regular reviews ensure your budget stays aligned with your needs and helps you identify areas for improvement.

What is the difference between the snowball and avalanche methods for debt repayment?

+The snowball method focuses on paying off the smallest debts first, providing quick wins and motivation. The avalanche method prioritizes debts with the highest interest rates, saving you money in the long run. Choose the method that aligns with your personal preferences and financial goals.

How much should I save for an emergency fund?

+Aim to save at least three to six months’ worth of living expenses for your emergency fund. This provides a solid buffer for most unexpected situations, such as job loss, medical emergencies, or major home repairs.

What are the benefits of investing for the long term?

+Investing for the long term allows you to take advantage of compound interest and market growth. Over time, your investments can significantly increase in value, providing a substantial boost to your financial portfolio.