How To Calculate Ebt

Effective after-tax profit margin is a key metric that measures a company's profitability after considering all expenses, including taxes. It provides valuable insights into a company's financial health and performance. In this step-by-step guide, we will explore the process of calculating EBT, examining its components, and understanding its significance in financial analysis.

Understanding EBT (Earnings Before Tax)

Earnings Before Tax (EBT) is a crucial financial metric that represents a company's profitability before taking into account income tax expenses. It is an essential indicator of a company's financial performance and provides valuable insights into its operational efficiency. By calculating EBT, investors, analysts, and stakeholders can assess a company's ability to generate profits and make informed decisions regarding its financial health.

EBT is calculated by subtracting operating expenses and other expenses from a company's total revenue. Operating expenses include costs directly related to a company's core operations, such as cost of goods sold, selling, general, and administrative expenses. Other expenses may include interest expenses, depreciation, and amortization. By excluding income tax expenses from the calculation, EBT focuses solely on the operational performance of the company.

The formula for calculating EBT is as follows:

EBT = Total Revenue - (Operating Expenses + Other Expenses)

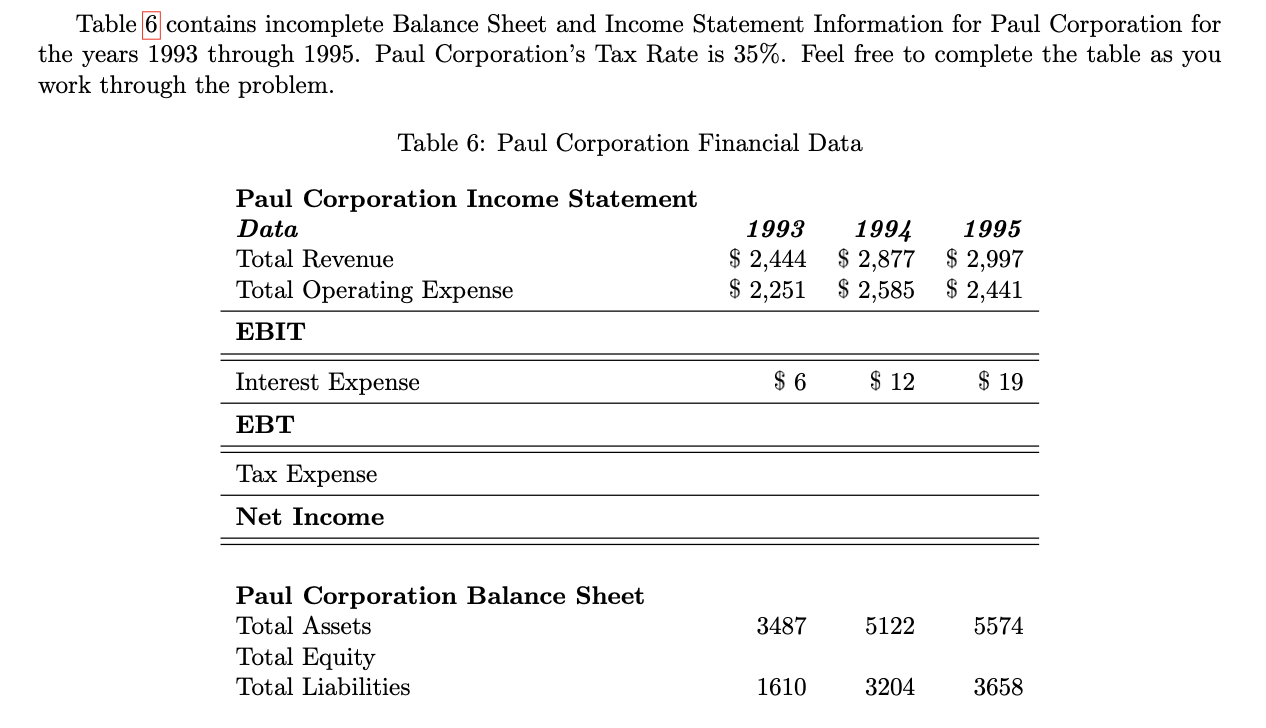

Here's a simple example to illustrate the calculation of EBT:

| Company ABC | |

|---|---|

| Total Revenue | $1,000,000 |

| Operating Expenses | $300,000 |

| Other Expenses | $150,000 |

| EBT | $550,000 |

In this example, Company ABC's EBT is calculated by subtracting the operating expenses ($300,000) and other expenses ($150,000) from its total revenue ($1,000,000). The resulting EBT is $550,000, indicating the company's profitability before considering income tax expenses.

Step-by-Step Guide to Calculating EBT

-

Gather Financial Data

The first step in calculating EBT is to collect the necessary financial information. This includes the company's income statement, which provides details on revenue, operating expenses, and other expenses. Ensure that the data is up-to-date and accurate to ensure precise calculations.

-

Identify Revenue

Revenue, also known as sales, represents the total income generated by a company through its business operations. It is typically the first line item on an income statement and is crucial for calculating EBT. Ensure that all revenue streams are considered, including sales of goods or services, interest income, and any other sources of income.

-

Determine Operating Expenses

Operating expenses are costs directly associated with a company's core operations. These expenses are necessary to maintain and support the business. Examples of operating expenses include cost of goods sold, selling expenses, general and administrative expenses, research and development costs, and marketing expenses. It is important to carefully analyze and categorize these expenses to ensure accuracy in the EBT calculation.

-

Identify Other Expenses

Other expenses refer to costs that are not directly related to a company's core operations but still impact its financial performance. These expenses may include interest expenses, depreciation, amortization, and any one-time or unusual expenses. It is crucial to distinguish these expenses from operating expenses to ensure a comprehensive EBT calculation.

-

Calculate EBT

With the necessary financial data gathered, it's time to calculate EBT. Use the formula mentioned earlier: EBT = Total Revenue - (Operating Expenses + Other Expenses). Plug in the values obtained from the financial statements and perform the calculation. The resulting EBT value represents the company's profitability before income tax expenses.

Importance of EBT in Financial Analysis

EBT plays a significant role in financial analysis and provides valuable insights into a company's financial performance. Here are a few reasons why EBT is important:

-

Profitability Assessment: EBT allows investors and analysts to evaluate a company's ability to generate profits from its core operations. By excluding income tax expenses, EBT focuses on the operational efficiency and effectiveness of the business.

-

Comparison and Benchmarking: EBT enables comparisons between different companies within the same industry. It provides a standardized metric that allows for a fair assessment of a company's financial performance relative to its peers. By analyzing EBT trends over time, investors can identify companies with strong operational performance and make informed investment decisions.

-

Financial Health Evaluation: EBT is a key indicator of a company's financial health. A positive and growing EBT suggests that the company is effectively managing its expenses and generating profits. On the other hand, a declining or negative EBT may raise concerns about the company's financial stability and require further investigation.

-

Tax Efficiency Analysis: EBT also provides insights into a company's tax efficiency. By comparing EBT to the company's pre-tax income, analysts can assess the impact of tax expenses on the overall profitability. This analysis helps in understanding the company's tax strategy and its ability to optimize tax liabilities.

Limitations and Considerations

While EBT is a valuable metric, it is important to consider its limitations and potential pitfalls. Here are a few considerations to keep in mind:

-

Tax Structure Variations: Different companies may have varying tax structures and tax rates. Therefore, comparing EBT across companies with different tax environments may not provide an accurate representation of their financial performance. It is essential to consider the tax structure and potential tax benefits or liabilities when analyzing EBT.

-

Non-Recurring Items: EBT calculations should exclude non-recurring items, such as one-time gains or losses, to ensure a fair assessment of a company's ongoing profitability. These non-recurring items can significantly impact EBT and may distort the analysis if not properly accounted for.

-

Industry-Specific Factors: EBT should be analyzed within the context of the industry in which the company operates. Certain industries may have unique cost structures or revenue models that impact EBT. Understanding industry-specific factors is crucial for accurate interpretation of EBT and its relevance to the company's financial performance.

To address these limitations, it is recommended to conduct a comprehensive financial analysis that goes beyond EBT. Consider other financial ratios, such as gross profit margin, operating profit margin, and return on equity, to gain a more holistic understanding of a company's financial health and performance.

EBT vs. Other Profitability Metrics

While EBT is a crucial profitability metric, it is important to understand how it differs from other commonly used metrics. Here's a comparison between EBT and two other key profitability metrics:

-

Gross Profit vs. EBT

Gross Profit: Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS) or direct production costs. It provides insights into a company's ability to generate profits from its core operations. Gross profit is calculated as:

Gross Profit = Revenue - Cost of Goods Sold (COGS)EBT vs. Gross Profit: EBT goes beyond gross profit by considering additional operating expenses and other expenses. While gross profit focuses on the direct production costs, EBT takes into account all expenses related to a company's core operations. EBT provides a more comprehensive view of a company's profitability by accounting for a wider range of expenses.

-

Operating Profit vs. EBT

Operating Profit: Operating profit, also known as earnings before interest and taxes (EBIT), represents a company's profitability from its core operations. It excludes interest expenses and income tax expenses. Operating profit is calculated as:

Operating Profit = Revenue - (Operating Expenses + Depreciation + Amortization)EBT vs. Operating Profit: EBT and operating profit are closely related, as both metrics focus on a company's operational performance. However, EBT includes additional expenses, such as interest expenses and other non-operating expenses, which are excluded from operating profit. EBT provides a slightly broader perspective by considering a wider range of expenses that impact a company's overall profitability.

Understanding the differences between EBT, gross profit, and operating profit allows for a more nuanced analysis of a company's financial performance. Each metric provides valuable insights into different aspects of a company's profitability, and considering them together can offer a comprehensive understanding of its financial health.

EBT and Financial Ratios

EBT is a fundamental metric that forms the basis for various financial ratios used in financial analysis. These ratios provide valuable insights into a company's financial performance, efficiency, and risk profile. Here are a few commonly used financial ratios that utilize EBT:

-

EBT Margin

The EBT margin is a profitability ratio that measures the percentage of revenue that a company retains as EBT. It provides insights into a company's ability to generate profits after considering all expenses, excluding taxes. The EBT margin is calculated as:

EBT Margin = (EBT / Total Revenue) * 100A higher EBT margin indicates that a company is more efficient in converting revenue into profits. It suggests that the company has strong operational efficiency and effective cost management.

-

Return on Assets (ROA)

Return on Assets (ROA) is a financial ratio that measures a company's ability to generate profits from its assets. It provides insights into the efficiency of a company's asset utilization. ROA is calculated as:

ROA = (EBT / Average Total Assets) * 100A higher ROA indicates that a company is effectively utilizing its assets to generate profits. It suggests that the company is able to maximize the return on its investments and efficiently deploy its resources.

-

Return on Equity (ROE)

Return on Equity (ROE) is a financial ratio that assesses a company's ability to generate profits for its shareholders. It measures the return on the shareholders' investment in the company. ROE is calculated as:

ROE = (EBT / Average Shareholders' Equity) * 100A higher ROE indicates that a company is effectively utilizing its equity to generate profits. It suggests that the company is creating value for its shareholders and maximizing their returns.

By analyzing these financial ratios alongside EBT, investors and analysts can gain a deeper understanding of a company's financial performance, efficiency, and risk profile. These ratios provide valuable insights into a company's ability to generate profits, utilize its assets, and create value for its shareholders.

EBT and Tax Strategy

EBT plays a crucial role in a company's tax strategy and planning. By understanding EBT, companies can make informed decisions to optimize their tax liabilities and improve their overall financial performance. Here's how EBT is related to tax strategy:

-

Tax Efficiency

EBT provides insights into a company's tax efficiency. By comparing EBT to pre-tax income, companies can assess the impact of tax expenses on their overall profitability. A higher EBT relative to pre-tax income indicates a more tax-efficient business, as it suggests that the company is effectively managing its tax liabilities.

-

Tax Planning and Optimization

EBT serves as a key input for tax planning and optimization strategies. Companies can analyze their EBT trends and identify opportunities to reduce tax expenses. This may involve exploring tax incentives, tax credits, or tax-efficient structures to minimize their tax liabilities. By optimizing their tax strategy, companies can improve their overall financial performance and increase their profitability.

-

Tax Compliance

EBT is also essential for tax compliance purposes. Companies must accurately calculate and report their EBT to comply with tax regulations and avoid penalties. Proper calculation and reporting of EBT ensure that companies meet their tax obligations and maintain a good relationship with tax authorities.

By leveraging EBT in their tax strategy, companies can effectively manage their tax liabilities, optimize their financial performance, and ensure compliance with tax regulations. It is important for companies to work closely with tax professionals and stay updated with tax laws and regulations to make informed tax-related decisions.

EBT in Different Industries

The concept of EBT is applicable across various industries, but its interpretation and significance may vary depending on the industry characteristics and business models. Here's how EBT is relevant in different industries:

-

Manufacturing Industry

In the manufacturing industry, EBT is particularly important as it provides insights into a company's ability to generate profits from its production processes. Manufacturing companies often have significant operating expenses, including raw material costs, labor costs, and overhead expenses. EBT helps assess the efficiency of these expenses and the overall profitability of the manufacturing operations.

-

Retail Industry

The retail industry heavily relies on EBT to evaluate the profitability of its operations. Retailers face various expenses, such as cost of goods sold, rent, marketing expenses, and employee costs. EBT allows retailers to analyze their operational efficiency and make informed decisions regarding pricing, inventory management, and cost control.

-

Technology Industry

In the technology industry, EBT is crucial for assessing the profitability of innovative products and services. Technology companies often invest heavily in research and development, marketing, and sales expenses. EBT helps evaluate the success of these investments and provides insights into the profitability of the technology offerings.

-

Financial Services Industry

The financial services industry, including banks and investment firms, relies on EBT to measure the profitability of their financial products and services. These companies have various expenses, such as interest expenses, employee costs, and regulatory compliance costs. EBT helps assess the efficiency of these expenses and the overall profitability of the financial services provided.

Understanding the relevance of EBT in different industries allows investors, analysts, and stakeholders to interpret financial statements and make informed decisions. EBT provides a consistent metric for comparing companies within the same industry, enabling a comprehensive analysis of their financial performance and operational efficiency.

Conclusion

Calculating EBT is a crucial step in understanding a company's financial performance and profitability. By following the step-by-step guide outlined in this article, you can accurately calculate EBT and gain valuable insights into a company's operational efficiency. EBT serves as a foundation for further financial analysis, allowing investors and analysts to make informed decisions and assess a company's financial health.

Remember, EBT is just one metric among many that contribute to a comprehensive financial analysis. It is important to consider other financial ratios, industry-specific factors, and tax implications to gain a holistic understanding of a company's financial performance. By combining EBT with other financial metrics, you can make well-informed investment decisions and evaluate a company's long-term sustainability and growth potential.

We hope this guide has provided you with a clear understanding of how to calculate EBT and its significance in financial analysis. Stay tuned for more insightful articles and resources to enhance your financial knowledge and investment strategies.

What is the difference between EBT and EBIT?

+EBT (Earnings Before Tax) and EBIT (Earnings Before Interest and Taxes) are both profitability metrics, but they differ in their calculation. EBT excludes income tax expenses, while EBIT excludes both interest expenses and income tax expenses. EBT provides insights into a company’s operational performance before considering taxes, while EBIT focuses on