Military Enlisted To Investment Banking

Transitioning from Military Service to a Career in Investment Banking: A Comprehensive Guide

The transition from military service to a career in investment banking can be challenging, but with the right skills, mindset, and preparation, it is certainly achievable. This guide aims to provide a comprehensive roadmap for military personnel looking to embark on this exciting career path.

Understanding Investment Banking

Investment banking is a dynamic and high-paced industry that plays a crucial role in the global financial market. Investment bankers work with clients to raise capital, provide financial advice, and facilitate complex financial transactions. The industry is known for its competitive nature and demanding work hours, but it also offers attractive financial rewards and the opportunity to work with some of the world's most influential companies and individuals.

Why Military Veterans Make Excellent Investment Bankers

Military veterans possess a unique skill set that is highly valued in the investment banking industry. Here are some key reasons why military experience can be a strong asset:

- Leadership and Teamwork: Military service often involves leading and working within diverse teams. This experience translates well to the collaborative nature of investment banking, where projects are often completed by cross-functional teams.

- Discipline and Work Ethic: The discipline and dedication required in the military are essential in investment banking. Long hours and demanding deadlines are common, and veterans are well-equipped to handle such challenges.

- Analytical Skills: Military personnel are trained to analyze complex situations and make critical decisions. This skill is invaluable in investment banking, where financial analysis and decision-making are daily tasks.

- Adaptability: The military often requires individuals to adapt to changing environments and circumstances. This adaptability is crucial in investment banking, where market conditions and client needs can shift rapidly.

- Attention to Detail: Attention to detail is paramount in both the military and investment banking. Whether it's following strict protocols or ensuring the accuracy of financial models, this skill is highly valued.

Education and Training

While prior military experience can be a strong advantage, it is important to note that investment banking also requires a solid educational foundation. Here are some key steps to consider:

Obtain a Relevant Degree

A bachelor's degree in a field related to finance, economics, or business is often a minimum requirement for entry-level investment banking positions. Consider pursuing a degree in finance, accounting, business administration, or a related field. Some veterans may already have these degrees, but for those who don't, it's never too late to start.

Consider an MBA

An MBA (Master of Business Administration) degree can be a significant asset in the investment banking industry. It provides a deeper understanding of business and financial concepts and can open doors to more senior-level positions. Many top business schools offer veteran-friendly programs and scholarships.

Financial Certifications

Obtaining financial certifications can enhance your resume and demonstrate your commitment to the field. Some popular certifications include the CFA (Chartered Financial Analyst) and the CPA (Certified Public Accountant). These certifications require rigorous study and passing exams, but they can significantly boost your career prospects.

Building Your Network

Networking is an essential aspect of breaking into investment banking. Here are some strategies to consider:

- Attend Industry Events: Keep an eye out for conferences, seminars, and networking events related to investment banking. These events provide an excellent opportunity to meet industry professionals and learn about the latest trends.

- Utilize Military Networks: Your military network can be a valuable resource. Reach out to fellow veterans who have successfully transitioned into investment banking. They can provide insights, advice, and potentially even referrals.

- Join Professional Organizations: Consider joining professional organizations such as the CFA Institute or the Financial Planning Association. These organizations offer networking opportunities and access to valuable resources.

- Online Communities: Online platforms and forums dedicated to investment banking can be a great way to connect with like-minded individuals and stay updated on industry news.

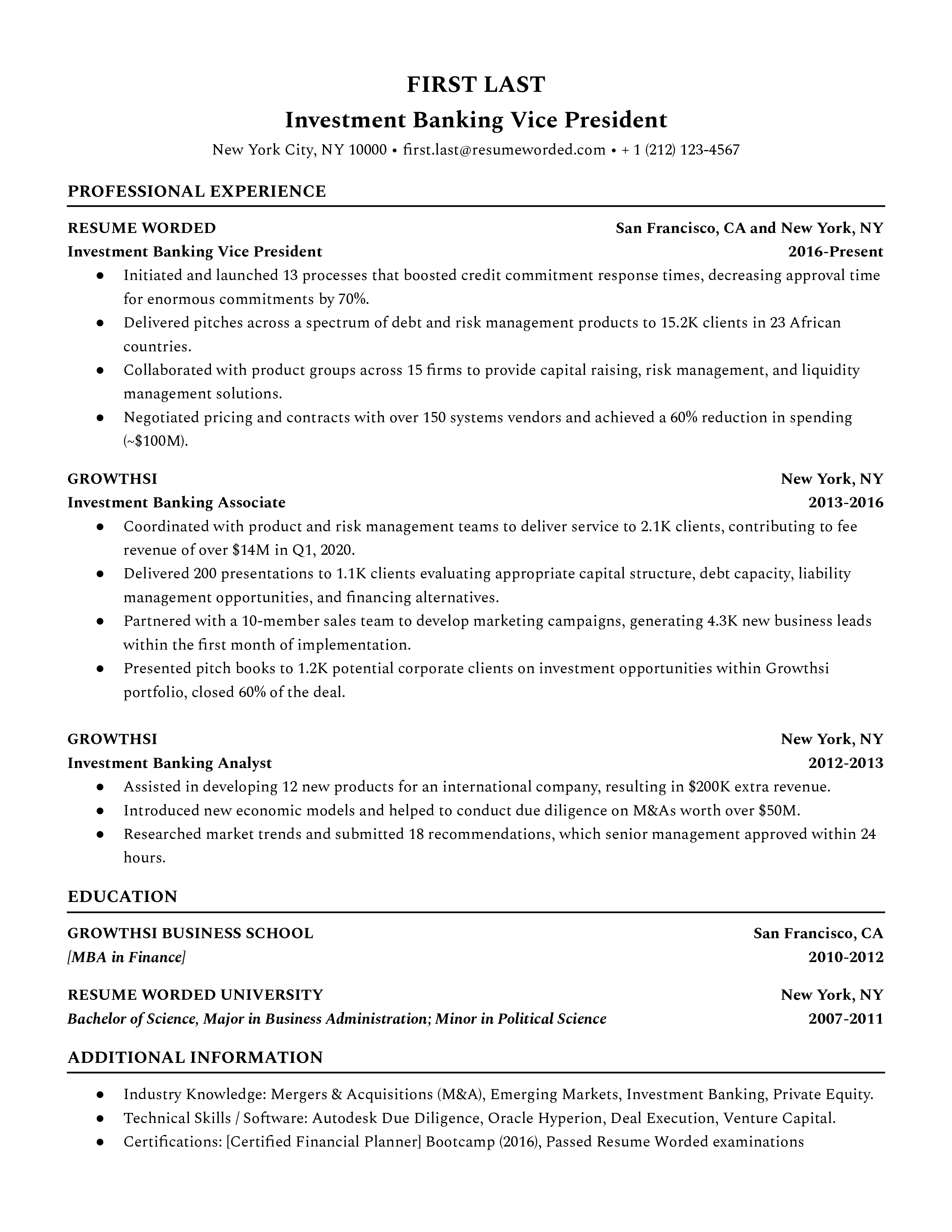

Applying for Investment Banking Roles

When applying for investment banking positions, it's important to tailor your resume and cover letter to highlight your relevant skills and experiences. Here are some key tips:

- Highlight Transferable Skills: Emphasize the skills you developed during your military service that are applicable to investment banking. This could include leadership, analytical abilities, or project management experience.

- Provide Specific Examples: Use concrete examples from your military career to illustrate your skills and accomplishments. This adds credibility to your application and helps hiring managers visualize your potential.

- Demonstrate Financial Knowledge: If you have completed any financial courses or have relevant certifications, be sure to highlight them. This demonstrates your commitment to the field and your understanding of investment banking fundamentals.

Interview Preparation

Investment banking interviews can be intense and highly technical. Here's how to prepare:

- Research the Firm: Thoroughly research the investment banking firm you are interviewing with. Understand their business model, recent transactions, and any recent news or developments. This demonstrates your interest and engagement.

- Practice Technical Questions: Investment banking interviews often include technical questions related to finance and economics. Practice answering these questions to build your confidence and improve your responses.

- Behavioral Questions: Be prepared to discuss your military experiences and how they have shaped your skills and character. Reflect on specific instances where you demonstrated leadership, problem-solving, or teamwork.

- Mock Interviews: Consider participating in mock interviews to simulate the real experience. This can help you identify areas for improvement and fine-tune your responses.

Internships and Entry-Level Positions

Gaining practical experience in investment banking is crucial. Consider the following options:

- Summer Internships: Summer internships are a great way to gain exposure to the industry and build connections. Many investment banking firms offer summer internship programs specifically designed for college students and recent graduates.

- Entry-Level Positions: Entry-level positions in investment banking often require a bachelor's degree and a strong academic background. These roles provide an opportunity to learn the ropes and work your way up the ladder.

- Veteran-Friendly Programs: Some investment banking firms have programs specifically designed to support veterans transitioning into the industry. These programs often offer mentorship, training, and a supportive environment.

Continuing Education and Professional Development

Investment banking is a field that requires continuous learning and professional development. Here are some ways to stay ahead of the curve:

- Conferences and Workshops: Attend industry conferences and workshops to stay updated on the latest trends and developments. These events often feature insightful presentations and networking opportunities.

- Online Courses: Online platforms offer a wide range of courses and certifications in finance and investment banking. These can be a convenient way to enhance your skills and knowledge.

- Mentorship Programs: Consider joining a mentorship program, either within your firm or through external organizations. Mentorship can provide valuable guidance and support as you navigate your career in investment banking.

Conclusion

Transitioning from military service to a career in investment banking is an exciting journey that requires dedication, education, and a strong network. By leveraging your unique military skills and experiences, and combining them with a solid educational foundation and practical industry experience, you can successfully make the transition and embark on a rewarding career in investment banking.

What are the key skills needed for a career in investment banking?

+Investment bankers require a strong foundation in finance, economics, and business. Analytical skills, attention to detail, and the ability to work under pressure are also crucial. Effective communication and teamwork are essential for collaboration within teams and with clients.

How can I stand out in a competitive investment banking job market?

+In a competitive market, it’s important to highlight your unique strengths and experiences. Emphasize your military background and the skills you’ve developed, such as leadership, adaptability, and problem-solving. Tailor your resume and cover letter to each job application, and consider obtaining advanced degrees or certifications to set yourself apart.

What are some challenges veterans may face when transitioning to investment banking?

+Veterans may face challenges such as adjusting to a different work culture, learning new technical skills, and navigating the competitive nature of the industry. It’s important to be open to learning, seek mentorship, and leverage your unique military experiences to add value to your new career path.

Are there any specific programs or resources for veterans interested in investment banking?

+Yes, there are several veteran-friendly programs and resources available. Many top investment banking firms have initiatives to support veteran recruitment and offer mentorship, training, and networking opportunities. Additionally, organizations like Veterans on Wall Street provide resources and support for veterans transitioning into the financial industry.

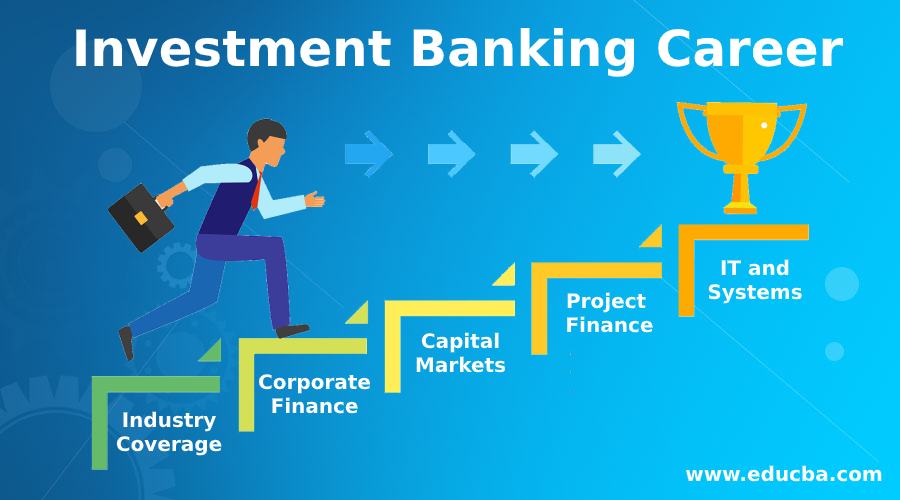

What is the typical career progression in investment banking?

+Career progression in investment banking typically follows a hierarchical structure. Entry-level positions include roles such as analyst or associate. With experience and expertise, individuals can progress to vice president, director, and managing director levels. It’s important to note that career progression can vary depending on the firm and individual performance.