Ultimate Guide: 6 Ways To Accept Ebt Now

Accepting EBT: A Comprehensive Guide for Businesses

The Electronic Benefits Transfer (EBT) system is a convenient and secure way for individuals to access their government-issued benefits, such as food assistance and cash benefits. As a business owner, accepting EBT can open up your customer base and contribute to financial inclusion. This guide will walk you through the process of accepting EBT, covering everything from the benefits to the necessary steps and considerations.

Understanding EBT

EBT is an electronic system that allows eligible individuals to access their government benefits, primarily for food assistance programs like the Supplemental Nutrition Assistance Program (SNAP). It provides a safe and efficient alternative to traditional paper food stamps, making it easier for recipients to purchase eligible items.

Why Accept EBT?

Increased Customer Base: By accepting EBT, you expand your potential customer base to include individuals who rely on government assistance. This can lead to increased foot traffic and sales, especially in areas with a higher concentration of EBT users.

Social Responsibility: Accepting EBT is a way for businesses to contribute to social responsibility and financial inclusion. It ensures that individuals from all socioeconomic backgrounds have access to your products or services, promoting equality and community support.

Government Incentives: Some governments offer incentives and support to businesses that accept EBT. These may include tax benefits, grants, or promotional opportunities, making it a mutually beneficial arrangement.

Steps to Accept EBT

Research Eligibility: Not all businesses are eligible to accept EBT. Typically, stores must meet certain criteria, such as selling eligible food items and having a minimum number of transactions per month. Research your state’s or country’s specific requirements to ensure you meet the criteria.

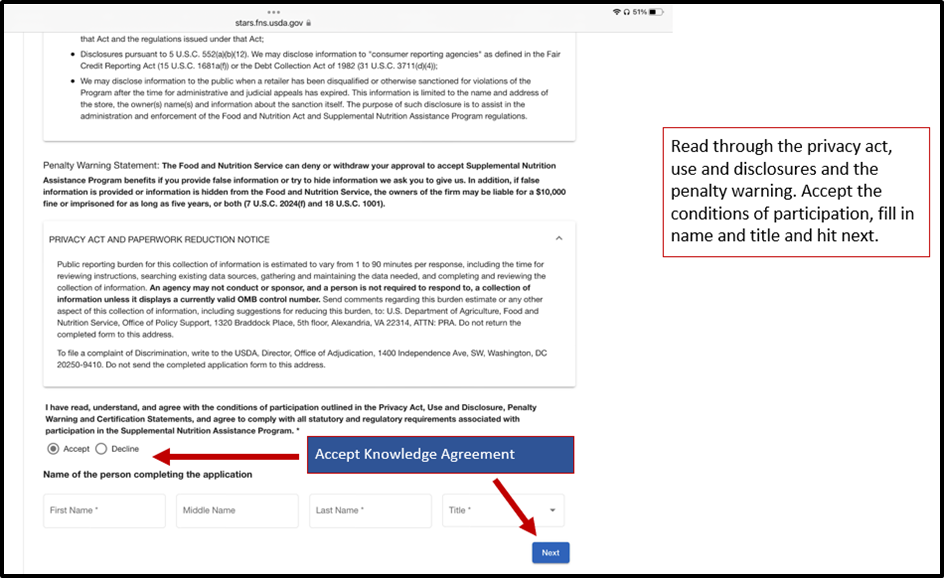

Apply for Authorization: Once you’ve confirmed your eligibility, you need to apply for authorization to accept EBT. This process involves submitting an application, providing necessary documentation, and possibly undergoing an inspection. The application process can vary depending on your location, so be sure to follow the guidelines provided by your local government agency.

Choose a Payment Processor: To accept EBT payments, you’ll need to partner with a payment processor that supports EBT transactions. Research and compare different processors to find one that suits your business needs. Consider factors such as transaction fees, customer support, and additional services they offer.

Set Up Your System: After selecting a payment processor, you’ll need to set up your point-of-sale (POS) system to accept EBT payments. This may involve installing specific software or hardware provided by your processor. Ensure that your staff is trained on how to process EBT transactions and understand the differences between EBT and traditional credit/debit card transactions.

Promote EBT Acceptance: Let your customers know that you accept EBT. Display EBT acceptance signs or logos at your entrance and near your checkout areas. You can also promote this information through your marketing materials, website, and social media platforms. Clear signage and promotion can help attract EBT users to your business.

Stay Informed and Compliant: Accepting EBT comes with certain responsibilities and regulations. Stay updated on any changes or updates to EBT policies and procedures. Ensure that your staff is trained on handling EBT transactions securely and efficiently. Regularly review your EBT sales reports to identify any potential issues or fraudulent activities.

Notes:

-

📝 Note: Eligibility criteria and application processes may vary depending on your location. Always refer to your local government's guidelines for accurate and up-to-date information.

-

📞 Note: If you have any questions or need assistance during the application process, don't hesitate to reach out to your local government agency or the payment processor you've chosen. They can provide guidance and support to ensure a smooth transition to accepting EBT.

-

💡 Note: Consider offering training sessions or workshops for your staff to ensure they understand the importance of accepting EBT and can provide excellent service to EBT users.

Conclusion

Accepting EBT is a valuable step for businesses looking to expand their customer base and contribute to financial inclusion. By following the steps outlined in this guide, you can ensure a smooth transition to accepting EBT payments and provide a convenient and accessible shopping experience for EBT users. Remember to stay informed, comply with regulations, and promote your EBT acceptance to maximize the benefits of this program.

FAQ

What is EBT, and how does it work?

+

EBT, or Electronic Benefits Transfer, is a system that allows eligible individuals to access their government benefits, such as food assistance, using an electronic card. It works similarly to a debit card, where the recipient’s benefits are loaded onto the card, and they can use it to purchase eligible items at participating stores.

Are there any costs associated with accepting EBT?

+

Yes, there may be transaction fees involved when accepting EBT payments. These fees are typically charged by the payment processor you choose to work with. It’s important to research and compare different processors to find one with competitive rates that suit your business needs.

Can I accept EBT for all types of transactions?

+

No, EBT is primarily used for food assistance programs like SNAP. It cannot be used for non-eligible items such as alcohol, tobacco, vitamins, or non-food items. It’s important to understand the restrictions and guidelines when accepting EBT to ensure compliance.

How can I ensure the security of EBT transactions?

+

To ensure the security of EBT transactions, it’s crucial to follow best practices for card-present and card-not-present transactions. This includes implementing proper security measures, such as using secure payment terminals, regularly updating your POS system, and training your staff on fraud prevention techniques.

Are there any government incentives for accepting EBT?

+

Yes, some governments offer incentives to businesses that accept EBT. These may include tax benefits, grants, or promotional opportunities. It’s worth researching and reaching out to your local government agency to explore any potential incentives available in your area.