What 15 Financial Managers Do: A Comprehensive Overview

Unveiling the Role of Financial Managers: A Comprehensive Guide

Financial managers play a crucial role in the success and stability of any organization, whether it’s a small business or a multinational corporation. Their expertise and strategic decision-making are vital for effective financial planning, analysis, and control. In this blog post, we will explore the diverse responsibilities and key tasks undertaken by financial managers, shedding light on their significant contributions to the financial health of businesses.

Core Responsibilities of Financial Managers

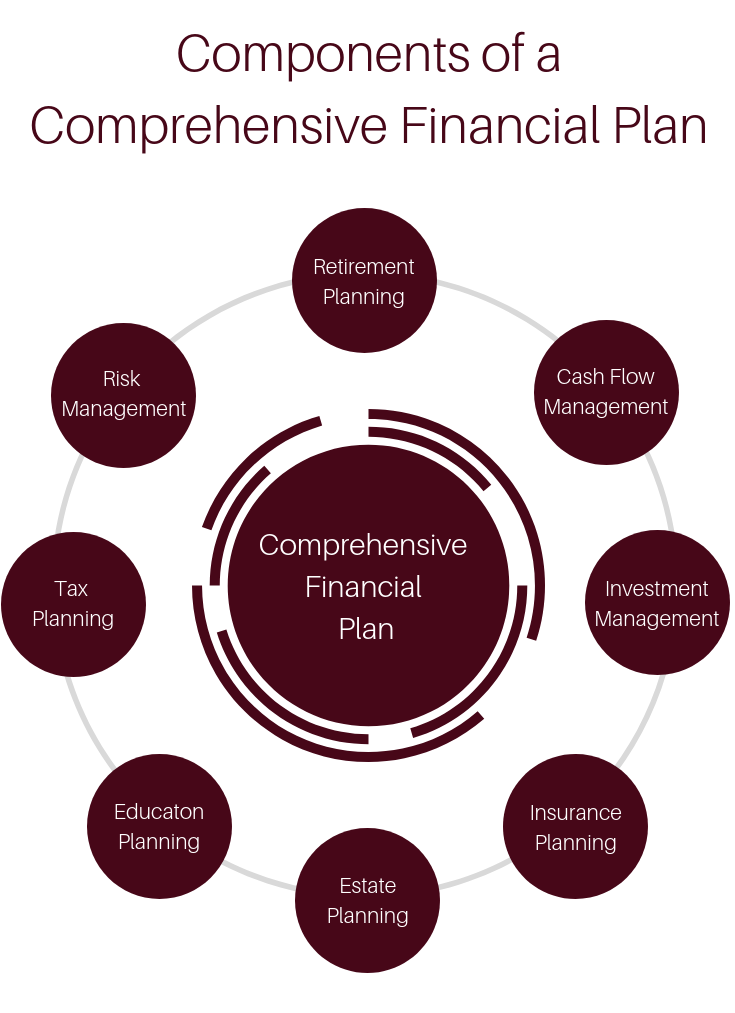

Financial Planning and Strategy: Financial managers are responsible for developing and implementing financial plans that align with the organization’s goals. They analyze market trends, assess risks, and create strategies to optimize financial performance. This involves setting financial targets, budgeting, and forecasting to ensure the business’s long-term sustainability.

Cash Flow Management: One of the primary duties is to manage cash flow efficiently. They ensure that the organization has sufficient funds to meet its obligations and invest in growth opportunities. This includes monitoring accounts receivable and payable, negotiating lines of credit, and optimizing cash reserves.

Financial Analysis and Reporting: Financial managers are adept at analyzing financial data to provide valuable insights. They prepare and present financial reports, balance sheets, and income statements to stakeholders. This information helps in making informed decisions, identifying areas for improvement, and tracking the organization’s financial health.

Risk Assessment and Mitigation: Identifying and managing financial risks is a critical aspect of their role. They assess potential threats, such as market fluctuations, changes in regulations, or economic downturns, and develop strategies to minimize their impact. This includes implementing risk management policies and insurance plans.

Investment Decisions: Financial managers guide investment decisions by evaluating potential opportunities and their alignment with the organization’s objectives. They assess the financial viability of projects, negotiate terms, and ensure that investments yield positive returns.

Budgeting and Cost Control: Creating and managing budgets is a key responsibility. They work closely with department heads to allocate resources effectively, monitor expenses, and identify cost-saving measures. This involves regular budget reviews and adjustments to ensure financial stability.

Financial Compliance and Regulations: Staying updated with financial laws and regulations is essential. Financial managers ensure that the organization complies with relevant tax laws, accounting standards, and industry-specific regulations. They also oversee internal controls to prevent fraud and maintain ethical financial practices.

Treasury Management: In larger organizations, financial managers may oversee the treasury department. This involves managing cash, investments, and financial instruments to optimize liquidity and minimize financial risks. They work closely with bankers and financial institutions to secure favorable terms.

Financial Forecasting and Modeling: Using advanced financial modeling techniques, they predict future financial scenarios. This helps in making strategic decisions, planning for expansion, and adapting to market changes. Financial forecasting provides a roadmap for the organization’s financial future.

Strategic Financial Partnerships: Building and maintaining relationships with financial institutions, investors, and partners is crucial. Financial managers negotiate financing options, secure loans, and explore partnerships that align with the organization’s financial goals.

Financial Team Leadership: As leaders, financial managers mentor and guide their financial teams. They provide training, set performance goals, and ensure that the team works collaboratively to achieve financial objectives. Effective leadership is essential for a high-performing financial department.

Financial Innovation and Technology: Embracing financial technology (fintech) is a growing aspect of their role. Financial managers stay updated with technological advancements, implement digital solutions, and leverage data analytics to enhance financial processes and decision-making.

Business Acquisitions and Mergers: When organizations consider mergers or acquisitions, financial managers play a pivotal role. They conduct financial due diligence, evaluate the financial health of potential partners, and provide strategic advice to ensure successful integrations.

Financial Crisis Management: In times of financial distress or economic downturns, financial managers step up to lead crisis management efforts. They develop contingency plans, renegotiate contracts, and implement cost-cutting measures to navigate challenging financial situations.

Financial Education and Communication: Effective communication is key. Financial managers simplify complex financial concepts for stakeholders, including investors, board members, and employees. They ensure that financial information is accessible and understandable to facilitate informed decision-making.

Notes:

💡 Note: Financial managers often specialize in specific areas such as corporate finance, risk management, or treasury operations, depending on the organization’s needs.

📊 Note: Financial modeling and forecasting require advanced analytical skills and a deep understanding of financial markets and economic trends.

🤝 Note: Building strong relationships with financial institutions and partners can lead to better financing options and strategic alliances.

Conclusion

Financial managers are the backbone of any organization’s financial operations, steering the business toward success and stability. Their expertise encompasses a wide range of responsibilities, from financial planning and analysis to risk management and strategic partnerships. By effectively managing financial resources, they ensure the organization’s long-term viability and growth. Understanding the diverse roles and contributions of financial managers highlights their vital importance in the business world.

FAQ

What qualifications are required to become a financial manager?

+Financial managers typically need a bachelor’s degree in finance, accounting, economics, or a related field. Many also pursue advanced degrees or certifications, such as a Master of Business Administration (MBA) or the Chartered Financial Analyst (CFA) designation, to enhance their expertise and career prospects.

How do financial managers contribute to a company’s strategic planning?

+Financial managers play a crucial role in strategic planning by providing financial insights and analysis. They help identify financial opportunities, assess risks, and develop financial strategies that align with the company’s goals. Their expertise ensures that financial considerations are integrated into the overall business strategy.

What are the key skills needed for a successful financial management career?

+Successful financial managers possess a combination of technical skills, such as financial analysis and modeling, and soft skills like communication, leadership, and problem-solving. They should also have a strong understanding of financial markets, regulations, and technology to adapt to the evolving business landscape.

How do financial managers stay updated with industry trends and regulations?

+Financial managers stay informed by regularly attending industry conferences, seminars, and workshops. They also subscribe to financial publications, follow industry news, and maintain professional networks. Continuous learning and staying updated with financial trends and regulations are essential for their role.

What are the career prospects for financial managers?

+Financial managers have excellent career prospects, with opportunities for advancement into senior leadership positions. They can specialize in areas like investment banking, corporate finance, or risk management, and their expertise is highly valued by organizations across industries.